In the wake of unprecedented disruption, the trucking industry is showing promising signs of resilience and recovery. After weathering one of the most challenging market downturns in recent history, carriers across the nation are adapting to a new normal—one that balances lingering pandemic effects with emerging opportunities for growth.

The Long Road to Recovery

The COVID-19 pandemic didn't just disrupt the trucking industry—it fundamentally transformed it. From volatile demand cycles to broken supply chains, carriers faced a perfect storm of challenges that tested even the most established operations. The pandemic's ripple effects continue to influence market dynamics, reshaping everything from equipment utilization to regional demand patterns.

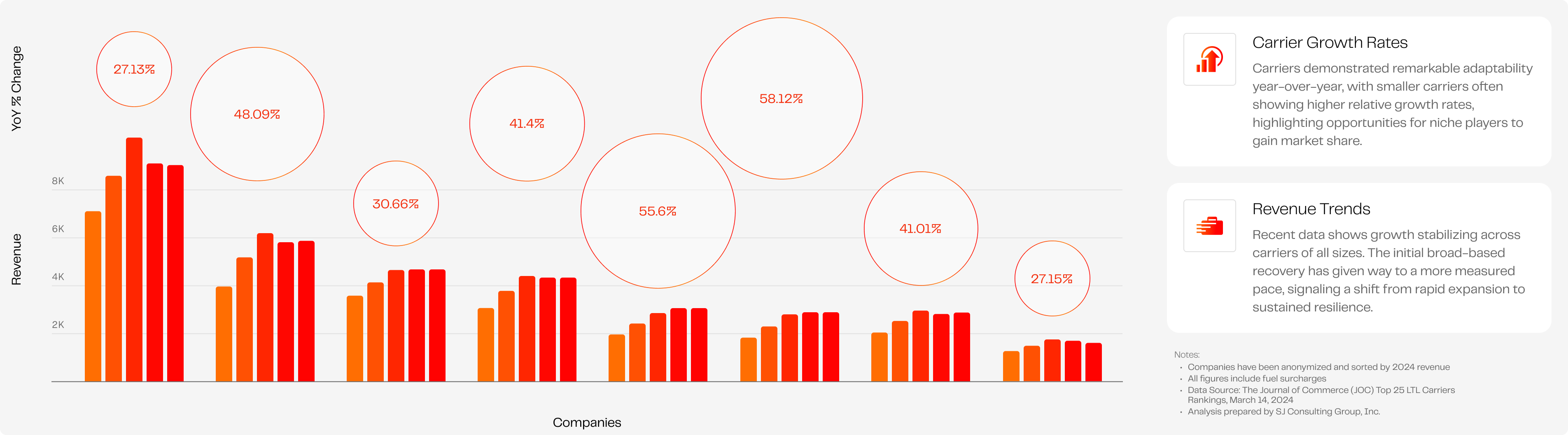

Yet amid these challenges, our data reveals an encouraging story of adaptation and resilience.

The New Carrier Landscape

The post-pandemic trucking ecosystem is characterized by several defining features that carriers and shippers alike must navigate:

Specialization vs. Flexibility

Today's carrier market showcases a fascinating dichotomy between hyper-specialization and operational flexibility. Temperature-controlled shipping, for example, has evolved into a highly concentrated market where specialized expertise isn't just preferred—it's essential. With 86% market share controlled by dedicated reefer carriers, this segment demonstrates how specialization creates both barriers to entry and operational stability.

Contrast this with the versatility seen in the van segment, where carriers have leveraged diverse equipment types to adapt to shifting market demands. This flexibility has proven invaluable during recent volatility, positioning van carriers as the workhorses of the recovery.

Seasonal Resilience

The industry's response to seasonal fluctuations tells us much about its underlying health. While summer slowdowns continue to affect overall volumes, the strong rebound in fall shipments suggests carriers are developing more effective strategies for managing these cyclical challenges.

For logistics planners, these seasonal patterns provide critical intelligence for capacity management—highlighting when to expect constraints and when to leverage potential surpluses.

Market Concentration Dynamics

Perhaps most telling is the high level of market concentration across specialized equipment segments. The flatbed market, dominated by standard configurations (91% of the segment), offers predictability but limited flexibility. Meanwhile, the tanker truck market's focus on chemical shipments demonstrates how carrier expertise and tailored equipment create natural concentrations within the industry.

This concentration creates both challenges and opportunities for shippers navigating these specialized spaces, making strong carrier relationships more valuable than ever.

Looking Ahead: Strategic Implications for 2025

As the industry continues its recovery journey, several strategic implications emerge for carriers and shippers alike:

Growth is real but variable – While overall industry growth shows promise, the uneven nature of this recovery demands strategic planning and segmented approaches.

Specialized expertise is paramount – In concentrated markets like temperature-controlled shipping and tanker transport, specialized carrier expertise represents a competitive advantage that can't be easily replicated.

Flexibility creates resilience – The van market's diverse equipment profile and operational adaptability offer valuable lessons in building resilience against future disruptions.

Relationship equity matters – In highly concentrated segments, the ability to build and maintain strong carrier relationships can mean the difference between consistent service and persistent challenges.

The Path Forward

The logistics market continues to evolve, balancing specialization with the need for operational flexibility. By understanding these emerging patterns, industry stakeholders can position themselves to thrive amid continuing change.

Our comprehensive 2025 Carrier Report dives deeper into these trends, offering data-driven insights and strategic recommendations for navigating this new landscape. From detailed equipment segmentation to carrier performance metrics across key lanes, the report provides the intelligence needed to make informed decisions in today's complex market.

Download our complete 2025 Carrier Report to access in-depth analysis of market concentration, equipment utilization trends, and growth forecasts that will shape the industry's continued recovery.